2023 Annual Review

Leadership

What a year! We celebrated the retirement of two longtime, beloved leaders over the summer: Executive Director Tom Wilson and Board President Robert Ives. I assumed the Executive role and Dr. LaVerne Lewis was elected as our new Board President. The Foundation may be under new leadership, but our mission hasn’t changed: we’re here to support the long-term financial health of faith communities. We’re in a strong position to do so. I hope you’ll enjoy reading our first-ever ESG report, checking out our year-end returns, and imagining how we might continue to partner with your church in the future.

With joy,

Julia Frisbie,

Executive Director

2023 Board Of Directors

Dr. LaVerne Lewis, President

Gaye Pierson, Vice President

Larry Nelson, Secretary

Barbara Dadd Shaffer, Treasurer

BOARD MEMBERS

Chris Bafus

Pastor Buddy Gharring

Mike Hartwig

Rev. Chuck Hindman

Coyote Marie Hunter-Ripper

Robert Ives, Esq.

Nik Halladay

Darrell Lowe

Cynthia MacLeod

Rev. Ron Myers

Rev. Lynn Rabenstein

Rev. Erika Spaet

Rev. John Watts

Em Rigler, Esq.

EX OFFICIO

Bishop Cedrick Bridgeforth

Brant Henshaw

Candace Clarke

EMERITUS

William Haden

ESG Report

Environment

175.53 metric tons of Carbon emissions

Supporting the Low-Carbon Transition

$125K in loan funding approved for solar projects

$82K in loan funding approved for energy-efficient HVAC systems

coming in 2024: participation in the PNW conference’s Heat Pump Fund and Solar for All program

3% secondary, which includes: power, postage, office supplies, telephone and internet service, furniture, insurance, and bank service charges.

Social

5 Staff Members

80% women

20% clergy

new for 2023: pay transparency

coming in 2024: regular wellness surveys, increased health benefits

Responding to the Bishop’s M.I.L.E.

$215K in loan funding approved for affordable housing predevelopment

$626K invested in affordable housing nationwide through Wespath’s Positive Social Purpose Lending Program

Governance

The Foundation undertakes a full audit every year, and also reports to the Office of the Insurance Commissioner.

21 Board Members

42% women

28% clergy

coming in 2024: representation from all four states we serve

6 Standing Committees

Executive

Loan

Investment

new for 2023:

Bylaws/Policy

Board Development

Grants/Scholarships

Portfolio performance

Diversified Conservative

1YR 3YR 5YR 10YR

13.42% 0.53% 6.81% 5.05%

Diversified Moderate

1YR 3YR 5YR 10YR

14.09% 0.51% 7.48% 5.24%

Diversified Aggressive

1YR 3YR 5YR 10YR

16.99% 1.28% 9.34% 6.51%

Our flagship diversified portfolios are comprised of funds managed by Wespath, the investment subsidiary of the United Methodist Church. They avoid investments in alcohol, tobacco, pornography, gambling, weapons, and private prisons. They engage companies and policymakers through formal requests, proxy voting, and shareholder resolutions. And they invest in things that make the world a better place: affordable housing, low-carbon energy solutions, and firms owned by women and minorities. At the close of 2023, 59% of our assets under management were held in these diversified portfolios.

Fossil Free Conservative

1YR 3YR 5YR

15.26% 1.86% 7.13%

Fossil Free Moderate

1YR 3YR 5YR

17.70% 3.47% 8.87%

Fossil Free Aggressive

1YR 3YR 5YR

19.11% 4.01% 9.45%

These fossil free portfolios were constructed in 2017. They share the same ethical screens as our diversified portfolios, and go a step further by also excluding Palestinian conflict companies and companies with fossil fuel reserves used for energy purposes. Wespath uses a combination of active and passive management in the funds that comprise these portfolios, which held 26% of our assets under management at the close of 2023.

Our Stable Value Portfolio’s goal is to provide high liquidity and minimal market fluctuation for “rainy day” funds. The portfolio consists of short to intermediate term laddered CDs, government notes, and secured loans. The loans are made to churches and agencies within our connection, and the interest paid on these loans contributes to the porfolio’s returns. Foundation staff have managed these funds for 30 years. Note: the Stable Value Portfolio produced lower than usual returns in 2021/22 due to historically low interest rates. Returns are improving with the rise of interest rates in 2023/24.

Stable Value

2023 2022 2021 2020

3.45% 0.47% 0.19% 1.93%

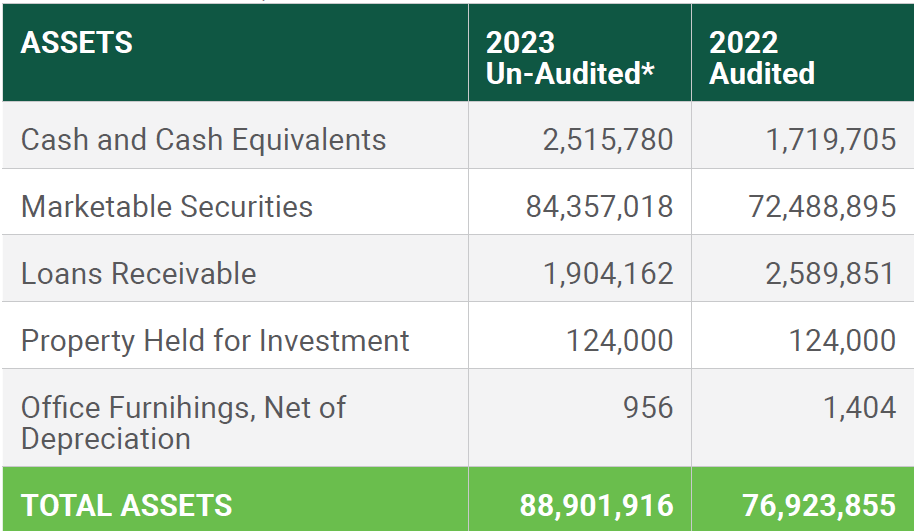

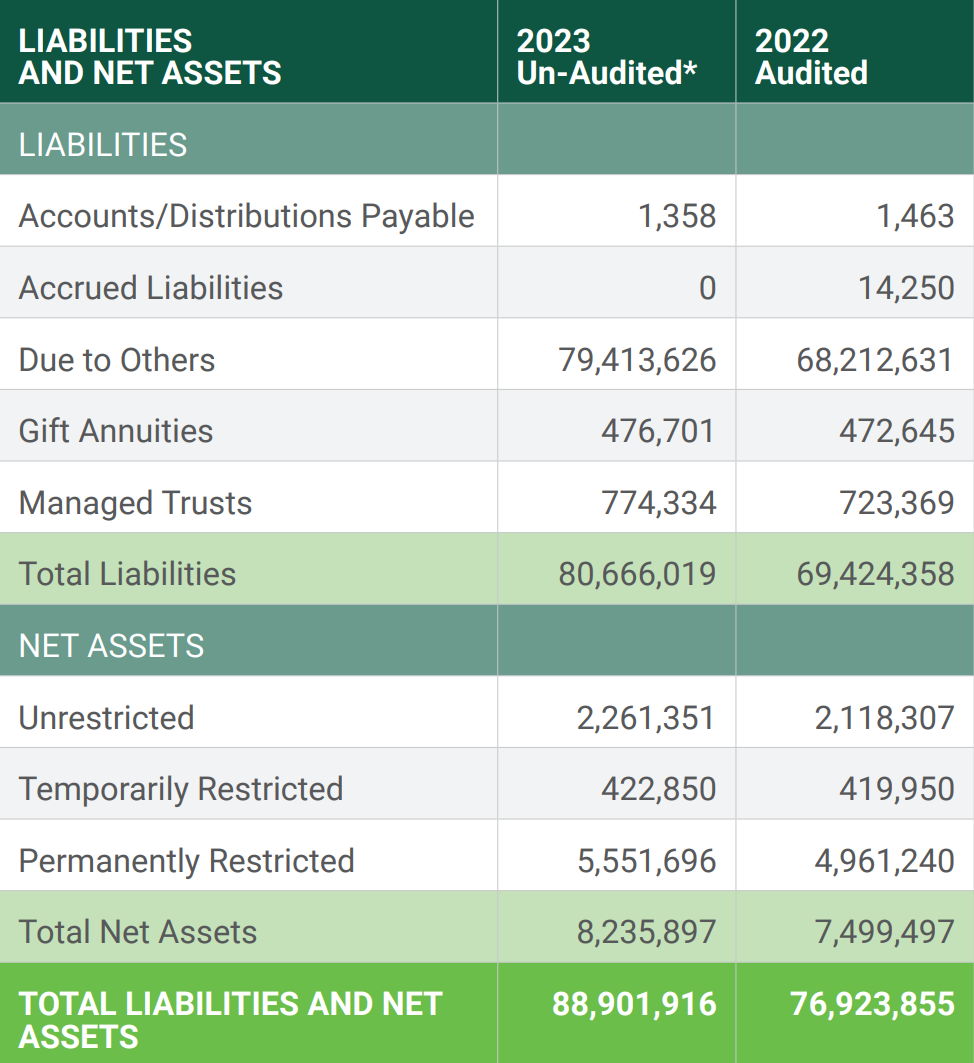

Consolidated Statements of Financial Position

As of December 31, 2023 & 2022:

*Audited 2022 financials are available upon request. Audited 2023 financials will be available after their publication in mid-2024.

Services we offer

Our faith guides our decisions and leads us to socially responsible and ethically sound funds that reflect the values of our team and the ministries we work with. In partnership with Wespath, we manage endowments, long-term investments, and reserve funds on behalf of churches, camps, conferences, and agencies.

We help churches fulfill their missions by offering low-hassle, below-market-rate term loans for capital improvements, plus bridge loans for special projects like affordable housing. Interest paid on church loans goes back into our faith community, supporting churches that have invested rainy-day funds with us.

Term loan interest: WSJ Prime - 0.5%

Bridge loan interest: WSJ Prime + 1.5%

We share and inspire stories of generosity and are committed to the lasting legacy of our clients and their congregations. We assist with endowment policies, procedures, and promotion.

We accept, liquidate, and pass through gifts of stock on behalf of faith communities, making tax-wise giving accessible for all donors.

We help guide people of faith in preparing a plan to provide for the ministries they love. We teach workshops, create materials, and work one-on-one with major donors upon request.

$88M UNDER MANAGEMENT

$29.4M LOANED SINCE 1991

$6.5M DEPOSITED INTO PERMANENT ACCOUNTS IN 2023

$5.4M STOCK GIFTS TRANSFERRED SINCE 2014

21 WORKSHOPS TAUGHT IN 2023