articles about investments

Throughout 2025, the U.S. economy proved more resilient than many experts expected, despite inflation concerns, political uncertainty, and shifting monetary policy.

Regardless of political or economic developments, we will continue to focus on long-term value creation, supported by prudent short-term liquidity management, to ensure that our portfolios remain resilient across a wide range of potential outcomes.

Despite various market concerns, all but two of our portfolios experienced positive gains in November, as the diversification of our portfolios continues to provide resilience against prevailing market conditions.

Regardless of the current political and economic circumstances, we will continue to maintain a disciplined approach to long-term value creation and prudent short-term liquidity management.

In October 2025, our portfolios experienced another positive month as markets continued to respond favorably to optimism around artificial intelligence, easing inflation, and a more supportive stance from the Federal Reserve.

As we head into the final quarter of 2025, Faith Foundation and our asset management partners continue to actively monitor evolving geopolitical and economic conditions to safeguard our clients’ interests. Our portfolios remain positioned for long-term growth and short-term liquidity.

The U.S. economy remains resilient; recession worries pushed to 2024; growth and employment beating expectations

Inflation hits 3.7% year over year in August, up from 3.0% in June

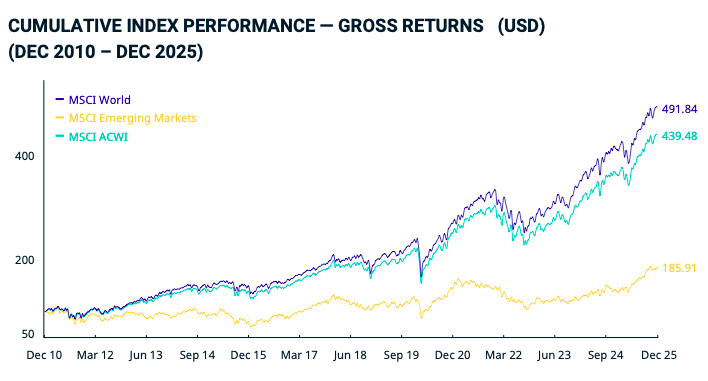

U.S. equities down 3.3% for the quarter, up 13% year to date

Global equities down 4.1% on the quarter, up 7% year to date

U.S. yields higher in Q3; bonds down 3.2% on the quarter and -1.2% year to date

John Wesley's legacy is marked by his teachings on social justice, compassion, and the vital role of actively expressing one's faith through acts of kindness, charity, and service to others. This philosophy urges individuals to consistently seek opportunities to create a positive impact in the world. The instructions to ‘Do no harm, do good and stay in love with God’ provide a simple-but-helpful perspective to guide that action!

Here at Wespath, I see clear connections between these rules and the work we do on behalf of our participants and institutional investors. For example, we are always called to empower our mission of ‘caring for those who serve’ and upholding our core values of Mutual Respect, Teamwork, Integrity, Stewardship, Customer Satisfaction and Spirituality. We also strive to live into our Wesleyan values more specifically through our investment work, including through the actions that guide our Sustainable Economy Framework and our ‘Invest-Engage-Avoid’ approach.

While we have always been able to highlight investment strategies and specific investments that help us achieve our aspirational vision for the economy, until recently we were not able to assess if our equity funds in totality are helping to move the world toward a more sustainable future.

To help address this challenge, we recently created an impact measurement and management (IMM) tool to help us understand how aligned—or not aligned—our investment portfolios are with the Framework.

In the simplest terms, the IMM tool is a resource that helps us understand how our investments align with our Framework by highlighting the positive and negative impacts of our portfolios

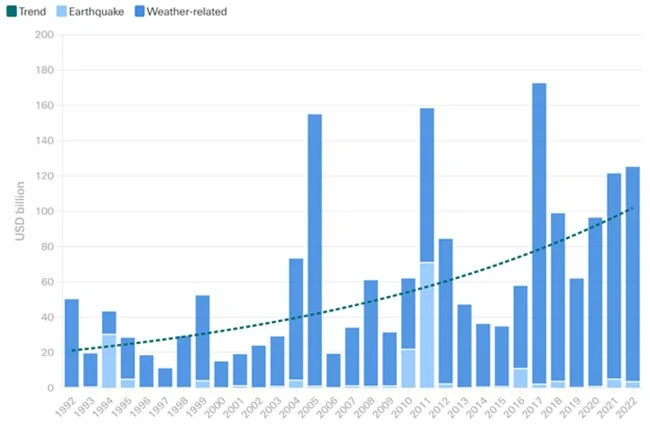

If you own a home in the U.S. and have noticed your insurance has increased over the last several years, you are not alone. The national average for homeowners insurance has been rising for the last five years, with a cumulative increase of 19.1% between 2018 and 2023. There are a number of reasons for this spike, including rising construction costs linked to inflation and, interestingly enough, the effects of climate change.

As long-term investors, we at Faith Foundation Northwest rarely react to or even address short-term market events. However, we’ve already received a few questions about the recent Silicon Valley Bank (SVB) situation and our answers to these questions are good news, so I want to share them with you today, along with the following brief from our investment partner Wespath.

In this quarter-end commentary, Wespath Managing Director Joe Halwax provides perspective on a persistently difficult economic landscape, including stubbornly high inflation, the Fed’s continued stance, a looming global recession, Europe’s energy crisis, the strength of the U.S. dollar, and more. Joe also indicates key areas to watch in the coming quarter.

Our asset manager Wespath “issued a joint call from 150 institutional investors for a fair, effective and equitable global response to the pandemic. This statement included a request for countries to fully fund the ACT Accelerator, a multi-stakeholder partnership dedicated to developing, producing and ensuring equitable access to COVID-19 tools.

Wespath believes that collaborative initiatives like the ACT Accelerator can be part of the solution. We have also engaged with pharmaceutical companies involved in the production of COVID-19 vaccines regarding their commitments to meet vaccine demand.”