Investment Insights Blog: Q2 Key Takeaways: Market Insights From the First Half of 2024

By Joe Halwax, CAIA, CIMA Managing Director, Institutional Investment Services. Originally published July 3, 2024 on Wespath.com.

U.S. GDP grew at 1.4% in Q1 2024, down from 3.4% for Q4 2023. The Atlanta Fed’s “GDP Now” estimate calls for Q2 GDP growth of 3.0%.

Expectations for U.S. interest rate cuts in 2024 have fallen from seven in January to just one as inflation remains stubbornly high. Year-over-year Consumer Price Index (CPI) inflation was 3.3% in May.

U.S. stocks returned an impressive 4.3% for Q2, while U.S. bonds were flat. The MSCI ACWI ex-U.S. Index (net) was up 0.9%, while the MSCI Emerging Markets Index rallied 5.1%.

Major U.S. stock market indexes remain dominated by a select few mega-cap tech companies, with Nvidia the standout winner. Nvidia is up 150% in 2024 and accounts for roughly a third of the S&P 500’s gains.

The European Central Bank (ECB) cut rates in June from 4.0% to 3.75%, marking a rare occasion where the ECB moves on policy before the U.S. Federal Reserve (Fed).

Did you know there have been over 30 new highs in the S&P 500 this year? Historically, there are 17 highs per year!

Investors often fear they are “buying the top.” But history shows that you shouldn’t necessarily be afraid of buying—even at new highs—especially if you’re someone with a long-term horizon who can weather sometimes extended periods of volatility.

Q2 Recap

It’s been a great start to 2024 for investors, and the second quarter looks much like the first: continued optimism on growth and slowly moderating inflation.

The “soft landing” scenario in the U.S. is now looking more like “no landing” scenario, meaning cooler inflation with no major slowdown in the economy. During the quarter, the forecast for Fed cuts again shifted lower, from three cuts and 75 basis points (bps) forecasted in April to just one cut and 25 bps expected, reflecting growing confidence in the no landing scenario. U.S. equities remain near all-time highs, with the S&P 500 up 15.3% year to date.

Strong returns for equities in Q1

While U.S. stocks ended up an impressive 4.3% for Q2, there was some interesting price action in the quarter. In April and May, we saw a 5.7% correction and recovery in the S&P500, followed by a 4% rally in June.

The April sell-off corresponded with higher inflation expectations and a move from 4.3% to a high of 4.7% for the 10-year U.S. Treasury yield. The S&P 500 has struggled recently when the 10-year yield is above 4.5%, as was seen in April and back in October 2023. But by the end of Q2, the 10-year had eased back down to 4.37%, which supported the June equity rally.

U.S. markets remain concentrated in growth and technology names. Both the S&P 500 and the tech-heavy NASDAQ have set new highs, while the more cyclically sensitive Russell 2000 Index of small-cap stocks lost 3.3% in Q2 and has returned just 1.7% year to date. Large-cap stocks continue to fare better in the backdrop of very loose fiscal but tight monetary policy as they have less need to borrow and may sit on cash reserves that can now provide interest income.

Why do U.S. stocks remain elevated?

While the reason for large caps’ recent dominance may seem clear, the big question we’ve heard all year is how U.S. stock markets generally can remain in rally mode despite fewer expected rate cuts. Let’s look at a few themes:

Multiple Expansion and Earnings Expectations: Most of the U.S. equity rally is attributable to expansions in earnings multiples rather than actual earnings growth. Investors are simply willing to pay more for certain U.S. stocks on the prospect of future earnings growth. U.S. earnings are expected to grow at 11% in 2025 and 14% in 2026, higher than the rest of the developed world. It’s worth noting that the Magnificent 7 stocks traded at 34x earnings as of late May, compared to 17x for the other 493 names in the S&P 500.

Further, we noted in Q1 that stocks are decoupling from rate expectations, with the focus shifting to earnings growth. According to FactSet, earnings in Q1 2024 grew at 6%, the highest year-over-year growth in two years. Q2 earnings season starts in earnest in mid-July. As seen in the chart from Capital Group below, earnings are still expected to grow in 2024 and 2025, supporting the equity rally.

Chart 1: Earnings Growth and Equity Valuations

(Source: Capital Group)

Buybacks: Stock buybacks remain at elevated levels. Fidelity’s Jurrien Trimmer wrote that, since 2009, “the issuance of shares totals $2.7 trillion, while the reduction in shares totals $21.3 trillion. That’s a huge supply/demand imbalance against a market cap of $44 trillion.”

In the chart below, new issuance is represented by the pink, while buybacks are in orange. This trend also helps explain why the highly profitable mega-cap companies have been so dominant in recent years—they are able to buy back shares at a greater rate.

Chart 2: Equity Supply and Demand

(As of June 2, 2024. Source: Fidelity Investments)

Mutual Funds: Securities rules prevent U.S. stock mutual funds from being overly concentrated. An allocation of more than 5% to a single name is considered high, and mutual funds must limit the total share of such positions to 25% of the fund to be considered “diversified.” Apple and Microsoft both have more than a 5% weighting in the S&P 500, so when their stock prices fall, mutual funds are able to buy them to get their levels back to 5%. That creates additional support for these and other mega-cap stocks.

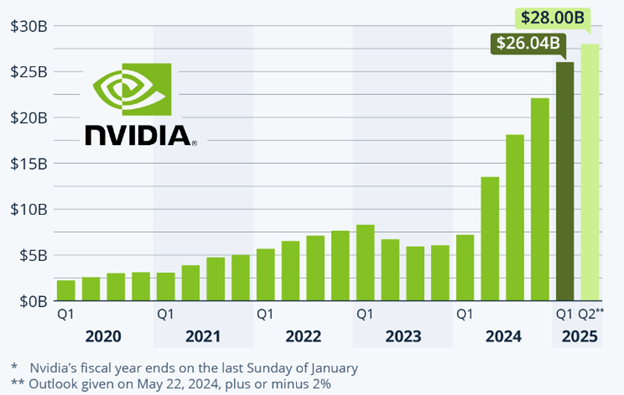

Nvidia: It is hard to not mention Nvidia. The chipmaker rallied 36% on the quarter and is now up 150% for the year. Nvidia’s quarterly earnings reports are seemingly as important as other major events such as employment or inflation data. Its latest report on May 22 again beat expectations for earnings and revenue. With growth names in favor from investors, the Nvidia’s 2.5x revenue growth over the past year continues to support its run and the artificial intelligence theme broadly.

Chart 3: Quarterly Revenue of Nvidia

(Source: Nvidia)

Taken together, we see that all of these themes are providing some inspiration for the U.S. equity market rally despite how much interest rate expectations have shifted this year.

Emerging markets notch solid quarter

International stocks were mixed for Q2, with emerging markets outperforming developed markets. The MSCI ACWI ex-U.S. IMI gained 0.9%. The MSCI EAFE Index was down -0.4%, while the MSCI Emerging Markets Index gained 5.1%.

Within the developed international markets, economic growth remains weak, but monetary easing has started, with the ECB cutting 25 bps in early June. Political uncertainty surrounding France’s parliamentary elections caused French equities to drop by 8% in June as the country shifts to a more populist stance.

Overall, global stock market breadth has improved in 2024, with a number of international markets at new highs and the MSCI All Country World Index recording an all-time high during Q2.

Yield curve continues to orbit 4.50%

Like the S&P 500, the ten-year U.S. Treasury yield had a roundtrip quarter. It started at 4.25%, peaking at 4.7% in April and 4.6% in May and then easing back to 4.25% to end June. Unsurprisingly, the Bloomberg U.S. Aggregate Bond Index was relatively flat on the quarter.

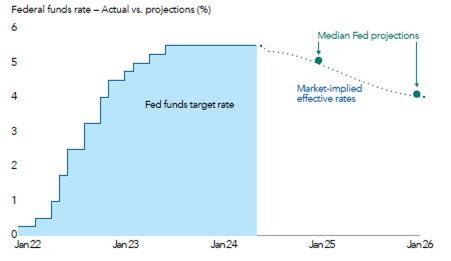

On June 12, the Federal Reserve met and provided a somewhat balanced stance on monetary policy, signaling just one rate cut for 2024. While many investors continue to push for a more aggressive policy, the Fed noted “inflation has eased over the past year but remains elevated” and “there has been modest progress towards the Committee’s 2% inflation objective.” The Fed’s “dot plot” of individual members’ rate expectations shows a more aggressive rate cut path for 2025 of five cuts or 1.25%.

Chart 4: Rate Cuts Are on the Horizon

(Source: Capital Group)

In the meantime, the yield curve remains persistently inverted, with the ten-year Treasury yield lower than the two-year Treasury yield for over two years now, the longest such period on record. The fiscal stimulus that occurred during and following the COVID pandemic is taking time to work its way through the economic system—not surprising given the magnitude of the stimulus. Once the Fed does pivot, the rate path described above should serve to normalize the yield curve.

Corporate fixed income has benefited from the stronger-than-expected economic growth, supported by a robust jobs market and consumer spending. Given this environment, corporate debt issuers are less likely to default on payments to bond holders. This, coupled with demand for yields that are much higher compared to the low yields of recent years, has caused spread compression.

Looking Ahead to the Second Half of 2024: Same Themes to Drive Markets?

As we head into the second half of the year, the market’s core questions will likely remain the same: Can inflation cool to levels closer to 2%? Will the Fed cut rates and, if so, by how much? Will U.S. earnings and AI/tech growth keep up? How will the U.S. and international elections and the ongoing conflicts in Gaza and Ukraine impact investors?

Right now, futures markets indicate there is a 70% chance of a 25 bps Fed rate cut in September, with 2.4 rates cuts expected by January 2025. All eyes will continue to focus on GDP and inflation in the U.S. to see if those expectations hold up.

We’re also gearing up for an election in November. That may create noise, and though historical data shows elections usually impact certain sectors at most while not having a major impact on broad indexes, it’s still another uncertainty to consider. We’ll see at the end of Q3 where things stand.