q3 Market Takeaways

The U.S. economy remains resilient; recession worries pushed to 2024; growth and employment beating expectations

Inflation hits 3.7% year over year in August, up from 3.0% in June

U.S. equities down 3.3% for the quarter, up 13% year to date

Global equities down 4.1% on the quarter, up 7% year to date

U.S. yields higher in Q3; bonds down 3.2% on the quarter and -1.2% year to date

What John Wesley's "3 Simple Rules" Teach Us About Values Aligned Investing

John Wesley's legacy is marked by his teachings on social justice, compassion, and the vital role of actively expressing one's faith through acts of kindness, charity, and service to others. This philosophy urges individuals to consistently seek opportunities to create a positive impact in the world. The instructions to ‘Do no harm, do good and stay in love with God’ provide a simple-but-helpful perspective to guide that action!

Here at Wespath, I see clear connections between these rules and the work we do on behalf of our participants and institutional investors. For example, we are always called to empower our mission of ‘caring for those who serve’ and upholding our core values of Mutual Respect, Teamwork, Integrity, Stewardship, Customer Satisfaction and Spirituality. We also strive to live into our Wesleyan values more specifically through our investment work, including through the actions that guide our Sustainable Economy Framework and our ‘Invest-Engage-Avoid’ approach.

New Tool Helps Us Measure the Impact of Our Investments in Public Markets

While we have always been able to highlight investment strategies and specific investments that help us achieve our aspirational vision for the economy, until recently we were not able to assess if our equity funds in totality are helping to move the world toward a more sustainable future.

To help address this challenge, we recently created an impact measurement and management (IMM) tool to help us understand how aligned—or not aligned—our investment portfolios are with the Framework.

In the simplest terms, the IMM tool is a resource that helps us understand how our investments align with our Framework by highlighting the positive and negative impacts of our portfolios

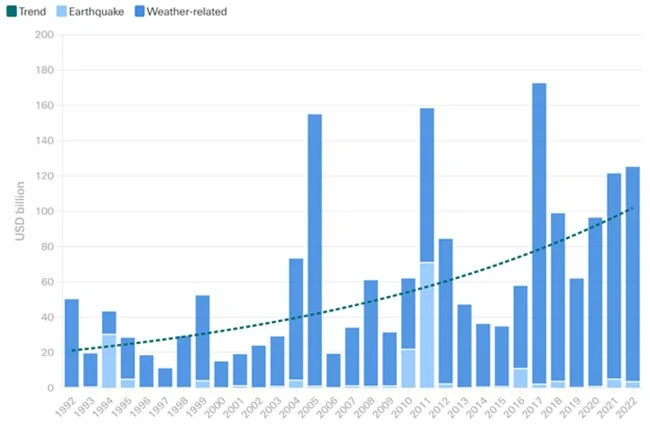

Why Climate Change Is Causing Higher Insurance Premiums and Intensifying the Housing Affordability Crisis

If you own a home in the U.S. and have noticed your insurance has increased over the last several years, you are not alone. The national average for homeowners insurance has been rising for the last five years, with a cumulative increase of 19.1% between 2018 and 2023. There are a number of reasons for this spike, including rising construction costs linked to inflation and, interestingly enough, the effects of climate change.

SVB’s Default, and Our Response

As long-term investors, we at Faith Foundation Northwest rarely react to or even address short-term market events. However, we’ve already received a few questions about the recent Silicon Valley Bank (SVB) situation and our answers to these questions are good news, so I want to share them with you today, along with the following brief from our investment partner Wespath.

Key Takeaways from Third Quarter’s Markets

In this quarter-end commentary, Wespath Managing Director Joe Halwax provides perspective on a persistently difficult economic landscape, including stubbornly high inflation, the Fed’s continued stance, a looming global recession, Europe’s energy crisis, the strength of the U.S. dollar, and more. Joe also indicates key areas to watch in the coming quarter.

The Fiduciary Case for COVID-19 Vaccine Equity

Our asset manager Wespath “issued a joint call from 150 institutional investors for a fair, effective and equitable global response to the pandemic. This statement included a request for countries to fully fund the ACT Accelerator, a multi-stakeholder partnership dedicated to developing, producing and ensuring equitable access to COVID-19 tools.

Wespath believes that collaborative initiatives like the ACT Accelerator can be part of the solution. We have also engaged with pharmaceutical companies involved in the production of COVID-19 vaccines regarding their commitments to meet vaccine demand.”

Risk management for institutional investors: to avoid, or to control?

I recently listened to a podcast focused on risk management in the investment process, recommended by our Chief Investment Officer, Dave Zellner. While Dave’s recommendations are always informative, this specific episode really piqued my interest as I often find myself having similar conversations about risk management with our institutional investors. While managing risk is clearly a key component of constructing and managing an investment portfolio, it’s also a phrase that brings about misconceptions compared to its practical application.

You asked: is my church invested in fossil fuels?

Dear Foundation,

Environmentalists in my church are asking the trustees whether or not we’re invested in fossil fuels. Right now our endowment is in your Diversified Moderate portfolio. That’s a socially responsible investment, right? What should I tell them?

Should You Be Worried About Inflation Right Now?

Concerns about the unprecedented economic downturn following the COVID-19 pandemic have dominated headlines for more than a year. But as vaccination numbers continue to rise and life begins to feel normal again for many around the country, the economic conversation is beginning to shift from recession to recovery—and even a potential overheating.

What Is a Fiduciary, Anyway?

Let’s be honest—all the terminology used in financial services is enough to make any investor’s head spin. Today I want to focus on one word often overheard in investment conversations, especially those driven by boards and investment committees: fiduciary.

So what exactly is a fiduciary?

Wespath’s Latest Shareholder Engagement on Human Rights Risk

Wespath’s process of shareholder engagement involves working with corporations, asset managers and policymakers to implement sustainable practices and policies, which we believe will lead to a more sustainable economy and improved investment returns.

Wespath Joins Joint UMC Commitment to Net-Zero Emissions by 2050

Glenview, IL—In the first net-zero commitment of its kind, Wespath Benefits and Investments (Wespath), along with other agencies of The United Methodist Church (UMC), today released a joint statement, “Our Climate Commitment to Net-Zero Emissions.” The collaborative, multi-institution statement pledges to achieve net-zero greenhouse gas (GHG) emissions across the organizations’ ministries, facilities, operations and investments by 2050. “Net-zero” describes the process by which human-caused greenhouse gas emissions can be balanced, or “netted out”, by removing emissions from the atmosphere.

The statement acknowledges that the UMC “has long affirmed our individual and collective responsibility to address the unfolding climate crisis.” In light of these values, the group said it was “called by our faith, informed by science, and led by our relationships with impacted communities” to respond urgently.

Wespath Sets Near-Term Portfolio Carbon Intensity Reduction Targets

In April 2020, Wespath joined the United Nations (UN)-convened Net-Zero Asset Owner Alliance (Alliance), committing to pursue strategies that will achieve net-zero portfolio emissions by 2050.

The Alliance and its members understand that this goal – one which aligns with the 1.5°C scenario outlined in the Paris Climate Agreement – looks well into the future. To help ensure we are on track to fulfill this long-term goal by 2050, Alliance members are setting near-term targets for achieving emissions reductions at certain intervals.

One Year Later…

Legendary investor Carl Icahn once said, “Don’t confuse luck with skill when judging others, and especially when judging yourself.”

Last week, I was in an airport for the first time in a year, feeling lucky and blessed. The last time I was on a plane was a year ago, for the same annual reunion with college friends of 30+ years.

As we arrived for that trip – on March 4, 2020 – the world was already beginning to shut down. Real uncertainty and fear were setting in on our daily lives. Many in the group had to jump on emergency work calls to discuss their office moving to virtual, and corporate travel was being put on hold indefinitely.

Paris Agreement Officially in Effect: What It Means for Investors

It's official: The United States re-entered the Paris Agreement last Friday, marking another important shift in global climate policy. The U.S. will now begin pursuing the goals of the landmark agreement—just one month after President Biden signed an executive order stating the world's largest economy's intent to rejoin the accord…

Why Small-Cap Stocks Have Been Outperforming Large Caps

Late in 2020, investors began to notice a shift in leadership in the U.S. equity markets. For the first time in several years, smaller company stocks (small caps) meaningfully outperformed larger companies (large caps). Let’s take a closer look at this trend, which has continued into the early weeks of 2021…

Value Investing Isn't Dead, It Just Needs Redefining

As I reflect on last year's market performance, I cannot help but notice that, despite all of the new things that happened in 2020, one of the most prevalent themes was the familiar debate around growth vs. value investing.

For the uninitiated, "growth" and "value" are terms used to categorize stocks based on fundamental company metrics. Generally, growth stocks are expected to see growth—measured by sales and earnings (profit) growth—at a higher-than-average rate compared to the overall market. These types of companies often do not pay dividends…