All Saint's Day Resources

As you plan ahead for stewardship season, we hope you’ll find time to be intentional about celebrating All Saints Day. This is an opportunity to provide pastoral care for families who have lost loved ones, and it’s also a time to lift up and celebrate the ways in which our ministry continues to be enriched by members who have gone on to glory. Done well, it becomes a gentle reminder about the opportunity for bequest giving.

Our friends and colleagues at the Mountain Sky United Methodist Foundation have developed a comprehensive resource for All Saints Day. This resource includes templates for letters to the families of the saints, worship elements, bulletin inserts, and more. You can download it in either PDF or Word:

2021 Stewardship resources

No one has the pat answer on how to do stewardship in a time of pandemic. But one of the strengths of our church is our connection with each other. Leaning on that connection makes us stronger and wiser as leaders. Instead of listing the usual stewardship resources this year, we’d like to share some samples of what your colleagues have created as a resource for you in planning your church’s stewardship this year. We are thankful for our contributors: Rev. Cara Scriven at Puyallup, Rev. Jeremy Hajdu-Paulen at Tigard, Rev. Peter Perry at Olympia and Rev. Geoff Helton at Audubon Park. You’ll need to consider both your leadership strengths and your congregational culture to help shape your plans, but I hope these resources will be a helpful reference and inspiration. Perhaps an idea will spark that is relevant to your setting!

Risk management for institutional investors: to avoid, or to control?

I recently listened to a podcast focused on risk management in the investment process, recommended by our Chief Investment Officer, Dave Zellner. While Dave’s recommendations are always informative, this specific episode really piqued my interest as I often find myself having similar conversations about risk management with our institutional investors. While managing risk is clearly a key component of constructing and managing an investment portfolio, it’s also a phrase that brings about misconceptions compared to its practical application.

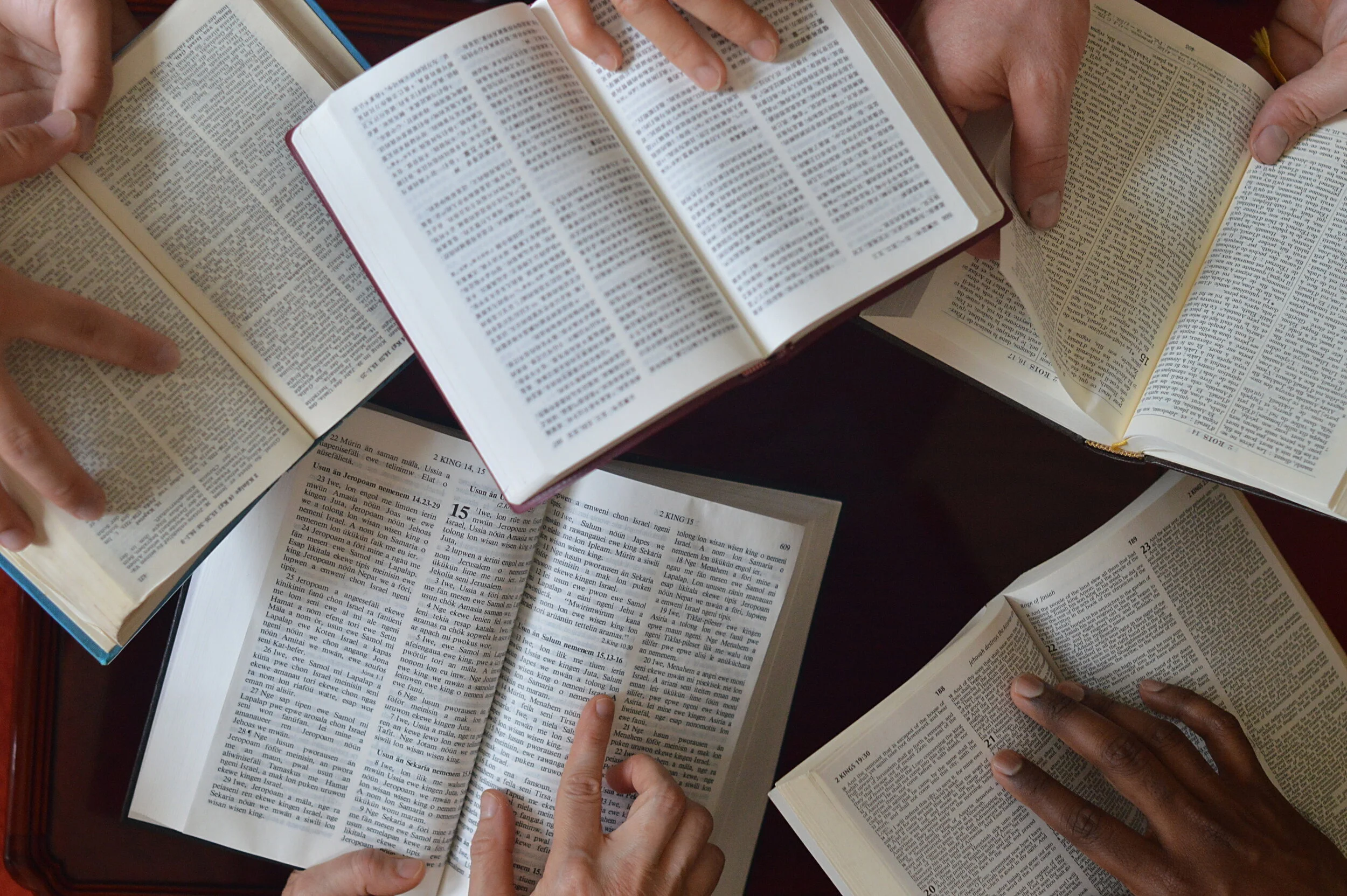

New Name, Same Foundation

After more than a year of discernment and visioning, we’re excited to share with you that our organization is changing its name from the Northwest United Methodist Foundation to Faith Foundation Northwest. This change is happening because we recognize that our future is both diverse and inclusive:

Diverse because denominational politics are creating complexity around what it means to be a United Methodist, while cultural shifts are driving new expressions of what it means to be a church. There are many ways to express faithfulness.

Inclusive because, no matter how the faith communities in our area choose to identify themselves, we will continue to serve alongside all of them.

You asked: is my church invested in fossil fuels?

Dear Foundation,

Environmentalists in my church are asking the trustees whether or not we’re invested in fossil fuels. Right now our endowment is in your Diversified Moderate portfolio. That’s a socially responsible investment, right? What should I tell them?

Should You Be Worried About Inflation Right Now?

Concerns about the unprecedented economic downturn following the COVID-19 pandemic have dominated headlines for more than a year. But as vaccination numbers continue to rise and life begins to feel normal again for many around the country, the economic conversation is beginning to shift from recession to recovery—and even a potential overheating.

What Is a Fiduciary, Anyway?

Let’s be honest—all the terminology used in financial services is enough to make any investor’s head spin. Today I want to focus on one word often overheard in investment conversations, especially those driven by boards and investment committees: fiduciary.

So what exactly is a fiduciary?

Wespath’s Latest Shareholder Engagement on Human Rights Risk

Wespath’s process of shareholder engagement involves working with corporations, asset managers and policymakers to implement sustainable practices and policies, which we believe will lead to a more sustainable economy and improved investment returns.

Wespath Joins Joint UMC Commitment to Net-Zero Emissions by 2050

Glenview, IL—In the first net-zero commitment of its kind, Wespath Benefits and Investments (Wespath), along with other agencies of The United Methodist Church (UMC), today released a joint statement, “Our Climate Commitment to Net-Zero Emissions.” The collaborative, multi-institution statement pledges to achieve net-zero greenhouse gas (GHG) emissions across the organizations’ ministries, facilities, operations and investments by 2050. “Net-zero” describes the process by which human-caused greenhouse gas emissions can be balanced, or “netted out”, by removing emissions from the atmosphere.

The statement acknowledges that the UMC “has long affirmed our individual and collective responsibility to address the unfolding climate crisis.” In light of these values, the group said it was “called by our faith, informed by science, and led by our relationships with impacted communities” to respond urgently.

Wespath Sets Near-Term Portfolio Carbon Intensity Reduction Targets

In April 2020, Wespath joined the United Nations (UN)-convened Net-Zero Asset Owner Alliance (Alliance), committing to pursue strategies that will achieve net-zero portfolio emissions by 2050.

The Alliance and its members understand that this goal – one which aligns with the 1.5°C scenario outlined in the Paris Climate Agreement – looks well into the future. To help ensure we are on track to fulfill this long-term goal by 2050, Alliance members are setting near-term targets for achieving emissions reductions at certain intervals.

One Year Later…

Legendary investor Carl Icahn once said, “Don’t confuse luck with skill when judging others, and especially when judging yourself.”

Last week, I was in an airport for the first time in a year, feeling lucky and blessed. The last time I was on a plane was a year ago, for the same annual reunion with college friends of 30+ years.

As we arrived for that trip – on March 4, 2020 – the world was already beginning to shut down. Real uncertainty and fear were setting in on our daily lives. Many in the group had to jump on emergency work calls to discuss their office moving to virtual, and corporate travel was being put on hold indefinitely.

Have You Set Up Online Giving Yet?

I recently got one of those emails that I love receiving: “I’m retiring soon and I’d like to set up the person who follows me for success. We still don’t have online giving. Can you help me figure out how to make it happen?”

Let me first say, BRAVO! Not only to tackling online giving, but for being so kind to the person who follows you. Again, BRAVO!

This person also indicated that some folks still weren’t sure that online giving was the way to go.

Here are a four things to remember about the importance and reality of online giving:

Paris Agreement Officially in Effect: What It Means for Investors

It's official: The United States re-entered the Paris Agreement last Friday, marking another important shift in global climate policy. The U.S. will now begin pursuing the goals of the landmark agreement—just one month after President Biden signed an executive order stating the world's largest economy's intent to rejoin the accord…

Why Small-Cap Stocks Have Been Outperforming Large Caps

Late in 2020, investors began to notice a shift in leadership in the U.S. equity markets. For the first time in several years, smaller company stocks (small caps) meaningfully outperformed larger companies (large caps). Let’s take a closer look at this trend, which has continued into the early weeks of 2021…

Value Investing Isn't Dead, It Just Needs Redefining

As I reflect on last year's market performance, I cannot help but notice that, despite all of the new things that happened in 2020, one of the most prevalent themes was the familiar debate around growth vs. value investing.

For the uninitiated, "growth" and "value" are terms used to categorize stocks based on fundamental company metrics. Generally, growth stocks are expected to see growth—measured by sales and earnings (profit) growth—at a higher-than-average rate compared to the overall market. These types of companies often do not pay dividends…

Wespath: Promoting Equity and Fighting Racism One Investment at a Time

Since 1908 Wespath Benefits and Investments protected the safety and futures of others. They are diligent in their research on potential investments, adapting to social changes and responsibly choose their investments to be good stewards of the United Methodist Church.

Although sustainable investing has long been part of Wespath’s fabric, the company recently has proven that an even broader perspective equals better performance for both their clients and the community as they have committed themselves to condemning racism, making boards more diverse and investing in minority-owned businesses.

“Our primary responsibility as a fiduciary is laid out in the Book of Discipline. That’s our guiding light,” said Jake Barnett, who is manager, Sustainable Investment Services for Wespath. “Within that there is also an aspiration to support the United Methodist Church’s social principles.”

Low Interest Rates for Churches Borrowing Money

With interest rates and building use both at historic lows, 2021 could be a great time for your congregation to tackle deferred maintenance or make a capital improvement that gives your ministry room to grow.

“We’ve been making these loans for 28 years, and today’s interest rates are the lowest we’ve ever been able to offer,” says the Foundation’s executive director Tom Wilson. “We’ve always set our interest rates by adding half a percent to the Morgan Stanley prime rate, and as of today, that puts us at just 3.75%.”

The Foundation has offered loans for church capital improvement projects since 1992. “I started the loan program because at that point, banks were asking pastors to co-sign loans for their congregations, and in an itinerant system that just didn’t make sense,” explains Wilson…